Market Environment Analysis Guide

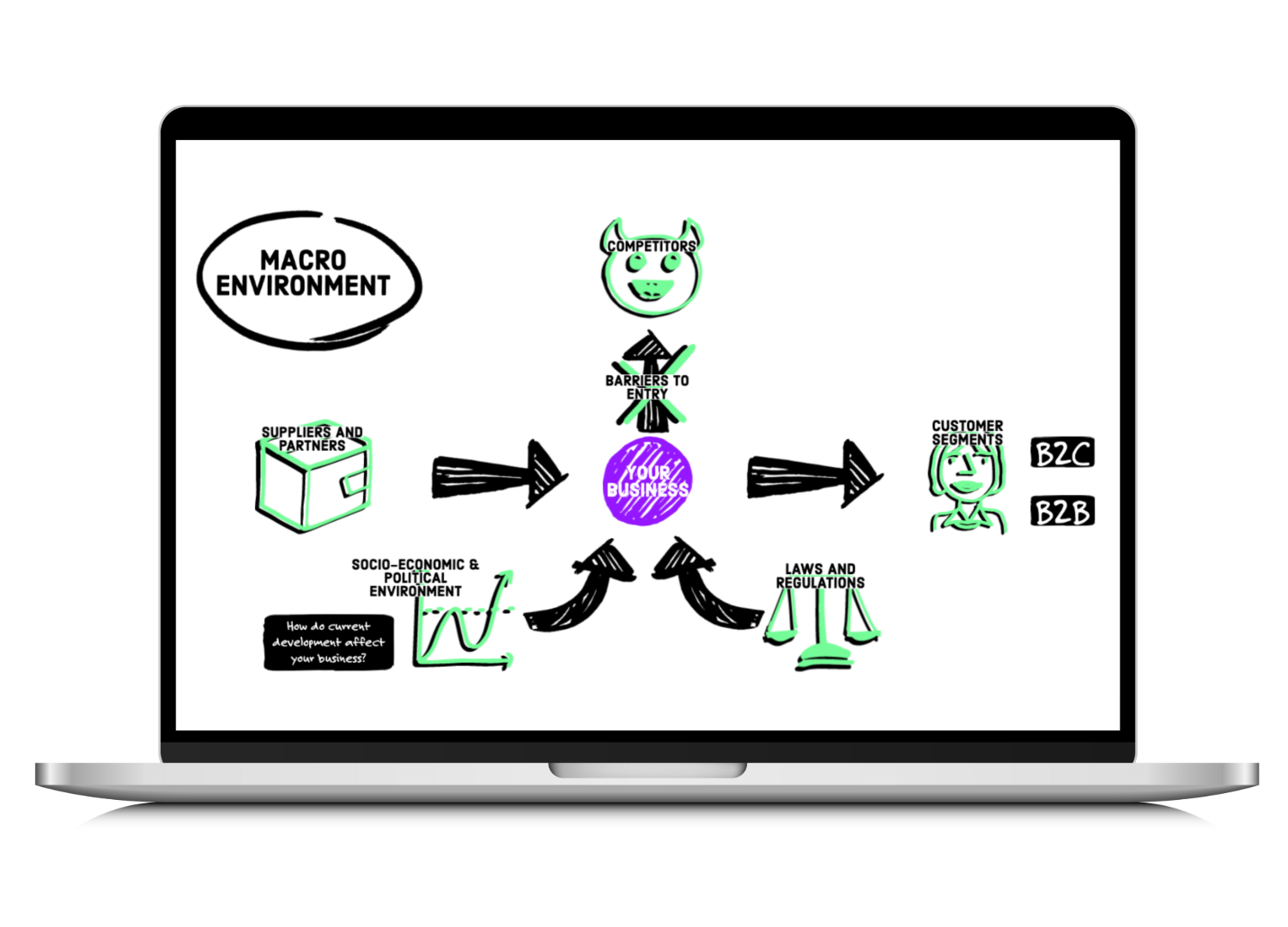

What is a Market Environment Analysis?

When you are building a new venture you want to examine the market environment you will be operating in, meaning the external factors that could have an impact on your business. It is not about conducting a hyper detailed macro economic analysis, but rather guiding you through a thinking process to bring to mind different variables to consider when starting your new venture.

There are a number of frameworks from great experts out there, like the PESTEL Analysis or Porter’s 5 forces. In our market environment analysis we are going to use elements of those frameworks and look at:

- The Macro-Environment:

- Your customer segments: Who and where are the customers you want to focus on?

- Your competitors: Who are the companies you will compete with?

- The barriers to entry: What could make it difficult to enter this market?

- Your suppliers: Who are the suppliers or partners you will need?

- Socio-economic and political environment: Which impact can current developments have on your business?

- Laws and regulations: Which regulations can have an impact on your business?

- The Micro-Environment : SWOT → What external opportunities and threats do you see, and which internal strengths and weaknesses can you identify?

Note: 🍋 Throughout this guide we will use the example of a food supplement company to better illustrate each task and information.

What is a Market Environment Analysis Good For?

A thorough market environment analysis is crucial for understanding the competitive landscape, consumer behavior, and industry trends. It will help you to:

- Make Informed Decisions: Understanding market dynamics assists in making strategic decisions based on real-world insights.

- Identify Business Opportunities: Analysis reveals untapped market segments and potential areas for growth.

- Mitigate Risks: Recognizing threats allows proactive measures to minimize risks and uncertainties.

- Easier Strategic Planning: Helps in devising business strategies aligned with market trends and demands.

- Optimize Resources: Enables efficient allocation of resources by focusing on key market areas.

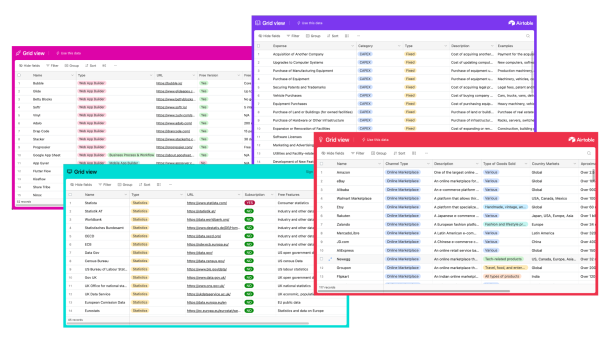

Curated Lists 📋

💡 To save you some time, we have prepared a free list with Company Information Sources and a free list Statistics & Data Resources with which you can use for your Market Environment Analysis

How to Conduct a Market Environment Analysis Step-by-Step:

Step A: Market Environment Analysis Template

Step B: Customer Segments

Step C: Competitors

Step D: Barriers to Entry

Step E: Suppliers and Partners

Step F: Socio-Economic and Political Environment

Step G: SWOT Analysis

Step A

Market Environment Analysis Template

To work on your market environment analysis you can either build your own whiteboard template for example on Miro or you can use our ready-to-use template along with this guide.

Included Templates:

Market Environment Analysis Miro Board

Step B

Customer Segments

The first step is to determine which customer segments you are going to target and serve with your products/services. Depending on your business you might sell very generic products/services and serve a broad range of customer segments or you are operating in a very specific niche that serves only a few customer segments.

Whatever it is, you should make sure you are clear about who it is that you are targeting, since this information will also be needed later to estimate the size of your market.

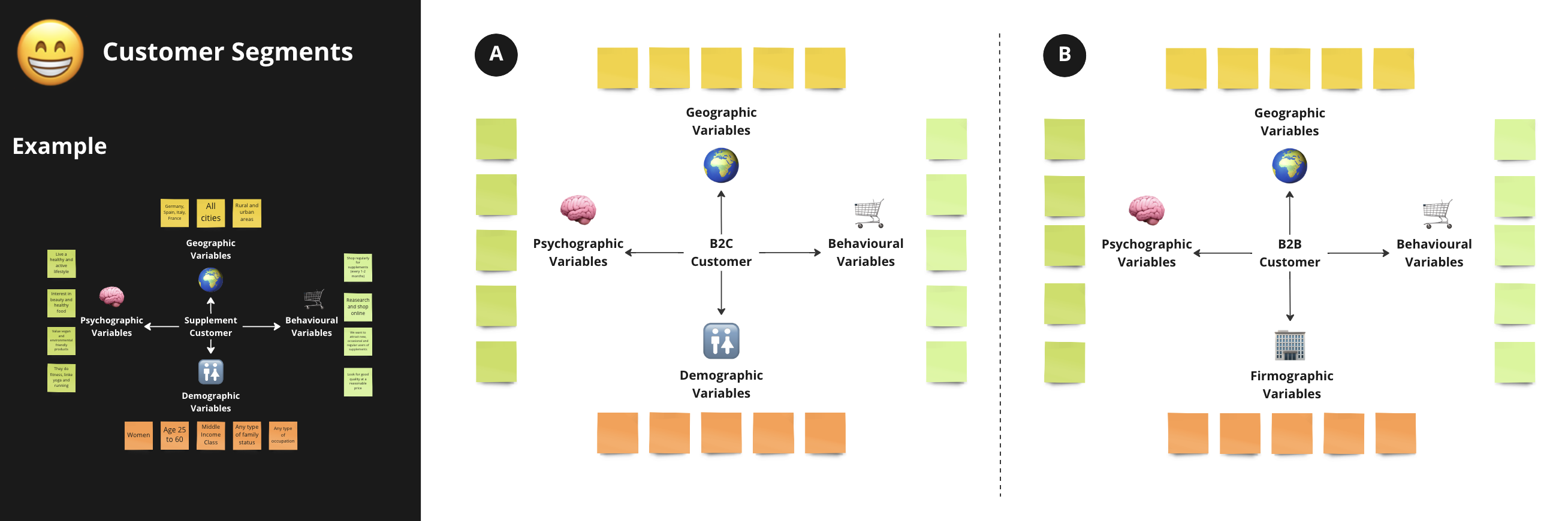

The first essential differentiation you will have to make is, if you are going to serve B2B clients, meaning other businesses or if you are targeting B2C customers, meaning consumers, or maybe both.

To further narrow down your target customers you want to use a number of segmentation variables. The relevance of the different variables can of course vary depending on your industry and the products/services you are selling, but there are some typical ones that will usually apply to the majority of businesses, we will look at them in a minute.

The types of variables will slightly differ for B2B and B2C segments, but one very key variable applies to both, namely the country market your future customers are located in. The country or countries you want to sell to will heavily impact all the other elements of the market environment analysis (competitors, barriers to entry, suppliers and the socio-, economic- and political environment).

However, let’s get started and look into the segmentation variables for each.

B2C (End User) Customers

🌍 Geographic variables: Are used to segment your customers by location, this can be on a higher level by region (e.g. EMEA), by country, or on a more detailed level if you only serve people in certain states, or cities. You can also differentiate if your target customers are located in rural or urban areas.

-

- Region

- Country

- State

- City

- Urban or rural areas

🙂 Demographic variables: Are used to segment your customers by observable people-based characteristics. Demographic segmentation is one of the most common types and demographic data on the population is quite easily available from public census records. Types of demographic data include:

-

- Gender

- Age

- Marital status

- Family size

- Income level

- Occupation

- Education Level

🛒 Behavioral variables: Are used to segment your customers by their shopping behavior, these variables are a little more complex since they are, A. no hard facts like your customers’ location or age and B. vary depending on the type of product (for example the shopping behavior for a car differs heavily from the one for cosmetic products). Think about the product/service you would like to offer. How would the ideal purchasing behavior look in your case? Behavioral variables for example include:

-

- Shopping channel – Where do they usually shop and search for products? Offline, on the web, on mobile?

- Shopping frequency – How often would they shop for your products habitually, seasonally, occasionally

- User status – How experienced are they using this type of product, are they new users, occasional users, regular users or expert users?

- Decision making – How do they decide which products to purchase, based on price, quality, brand status etc.?

🧠 Psychographic variables: Are used to segment by their personal characteristics. Just as the behavioral variables, psychographic ones are quite complex and not easy to categorize since they vary heavily on an individual level. At this point it is not about figuring out exactly who your potential customers are, but rather about painting a rough picture of the type of people who would be using your product/service. Those variables for example include:

-

- Lifestyle – How do your target customers live? Are they jetsetters, or small town family people, do they live a very active and healthy life or spend their time reading and watching TV?

- Interests – What are their hobbies? What do they like to do in their freetime? Are they into fashion? Do they like sports? Are they artsy?

- Values – Which values do they represent and live by? Do they look after the environment? Are they looking for popularity or uniqueness? Do they value reliability or honesty?

B2B (Business) Customers:

🌍 Geographic variables: Are also used for B2B clients to segment them by location, this can be on a higher level by region (e.g. EMEA), by country, or on a more detailed level if you only serve businesses in certain states, or cities. You can also differentiate if your target clients operate in rural or urban areas.

-

- Region

- Country

- State

- City

- Urban or rural areas

🏢 Firmographics variables: Are the B2B counterpart to demographic variables and are used to segment your clients by observable company-based characteristics. You also commonly find data on public records and company databases. Types of firmographic data include:

-

- Company size – How many employees (range) do your target clients have? Are they entrepreneurs, small businesses, medium businesses or large corporations?

- Company revenues – In which revenue range are they, how much do they make on average in a year?

- Industry/sector – in which sectors do your target clients operate in?

- Company age – Are your target clients young startups, established modern companies born in the last 20 years or old traditional companies with a long history?

🛒 Behavioral variables: Just as for B2C customers, these variables are used to segment your B2B clients by their purchasing behavior. Also in this case these variables are a little more complex since they are A. no hard facts like your customers location or age and B. vary depending on the type of product. Think about the product/service you would like to offer. How would the purchasing behavior of your clients look in your case? Behavioral variables for example include:

-

- Shopping channel – Where do they usually shop and search for products? Through direct consultation with a sales person, their network or through online channels?

- Shopping frequency – How often would they shop for your products? Habitually, seasonally, occasionally?

- User status – How experienced are they using this type of product? Are they new users, occasional users, regular users or expert users?

- Decision making – How do they decide which products to purchase? Based on price, quality, brand status etc.? And who is the decision maker, is it IT, Marketing, Maintenance?

- Switching cost – How likely and easily can they switch to a new provider? Are switching costs rather high or low? (It is for example easier to switch to a new marketing agency than to change to a whole new enterprise software)

🧠 Psychographic variables: Just as for individual people we can also use psychographic variables to segment businesses by their individual characteristics. Again those variables are rather complex and not easy to categorize, since they vary heavily on an individual business level. At this point it is not about figuring out exactly who your potential clients are, but rather about painting a rough picture of the type of businesses that would be using your product/service. Those variables for example include:

-

- Working style – How do they work, are they young and digital companies that embrace remote working or do they like to work from an office and hold in-person meetings? Are their processes longsome and well analyzed or are they fast and dynamic?

- Company culture – What type of company culture do your target clients embrace, modern or traditional? Are they structured and strict or open and casual?

- Company values – Which company value do your clients represent? Are they environmentally friendly, digital and innovative, engaged in society etc.?

☝️Based on those segmentation variables, use the section “Customer Segments” in your Market Environment Analysis 📒Template to think about how your ideal target customers would look like and describe them using the post-its.

Step C

Competitors

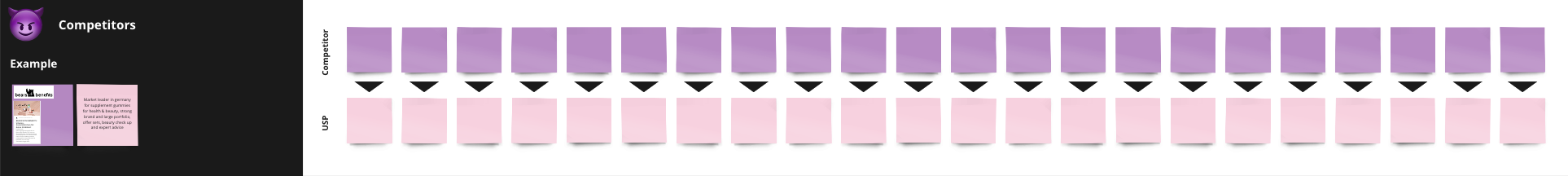

Once you have established your target customer segments, think about who you are competing with in this segment. You can take into consideration both, direct competitors, meaning businesses within the same market which sell products/services that are very similar to yours, or indirect competitors that are offering products that are not exactly the same as yours but serve the same need and could work as an alternative. Depending on the level of innovation you might even be a first mover in your area and don’t have any direct competition yet.

You probably already have identified a number of competitors during any previous research you did. However, at this stage we want to consider only those who really serve the same markets as you would. Meaning, if you for example only want to target the German market, a company (competitor) that operates in Asia would not be relevant in this case.

So, as a first step, select those companies that you would compete with in your market and copy them to your competitor analysis board.

💡 To find competitors you can use the Competitor Information Sources List we provided above.

The sources include:

- Company/startup databases including national company directories

- VC portfolios

- Keyword/website analysis tools by checking the sites that compete for certain keywords

- and of course good ol’ Google search

☝️List them in the corresponding section of your Market Environment Analysis 📒Template (one post-it per competitor) and add their USP (Unique Selling Proposition), meaning the element that makes the competitor special, to the second post-it.

Try to be exhaustive and really create a full list of all potential competitors in your market, since this will build the basis for the competitor deep dive on day three.

Step D

Barriers to Entry

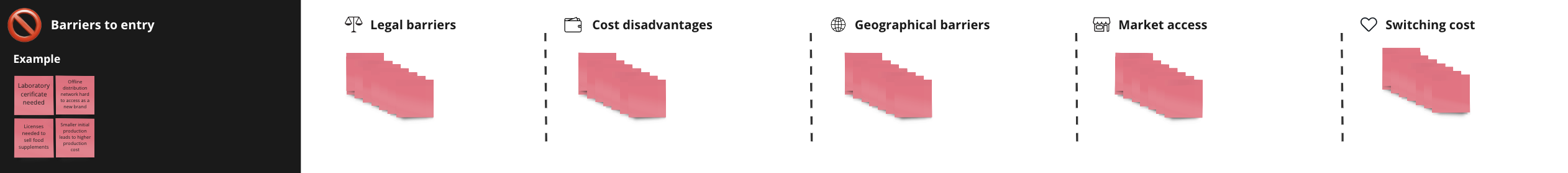

In the next step you want to understand what the entry barriers are, meaning the factors that could prevent or make it difficult to enter your market for you or other competitors.

Those factors can include:

- Legal barriers – Are there any specific laws or regulations concerning your products/services in the countries you operate in? Do you need any special licenses to produce or sell this product/service?

- Cost disadvantage – Do existing competitors have a cost advantage over you for example because of economies of scale or better negotiation power with suppliers?

- Geographical barriers – Are there any country related barriers if you are selling outside your home country? Are there for example any language barriers or do you need special permits to sell in this country?

- Market access – How easy is it for you to gain access to suppliers or distributors? Would you have a great disadvantage compared to established competitors?

- Switching cost – How loyal are customers in this target market towards existing brands? Are there competitors in the market with a high brand preference? How high are the costs for the customer of switching to another brand?

The barriers to entry vary depending on the industry and of course geographic markets. Think about what the barriers to entry could be for your industry in the country(ies) you want to enter and note them down in the corresponding area of your Market Environment Analysis 📒Template

Step E

Suppliers and Partners

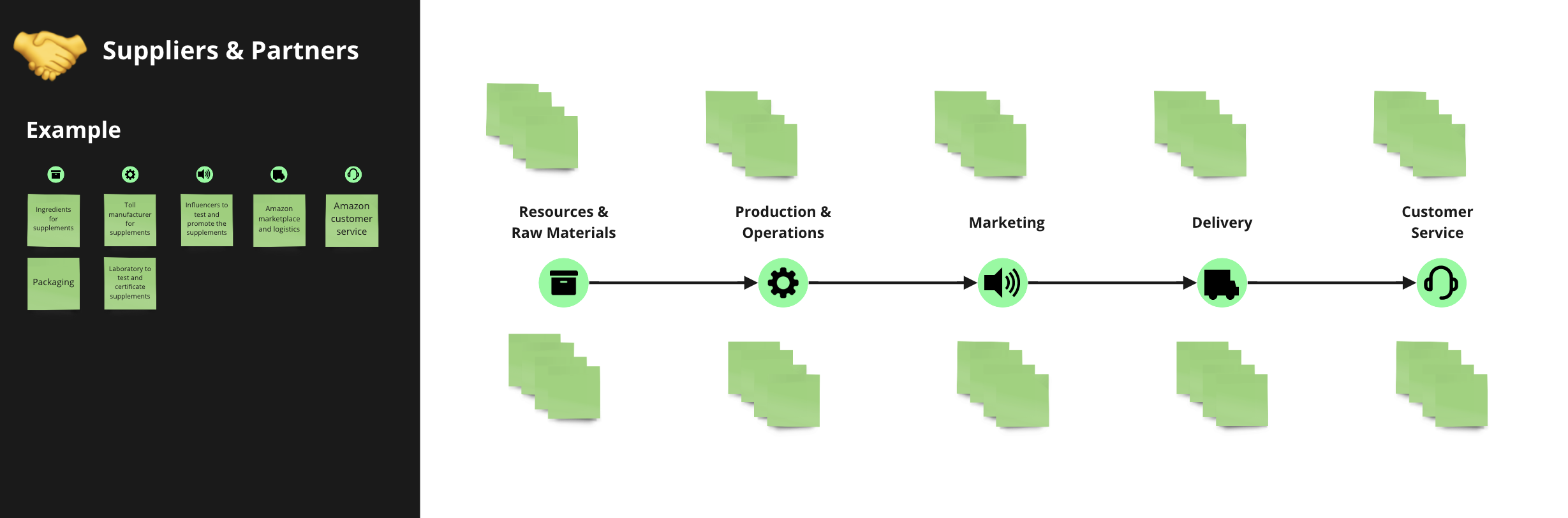

It doesn’t matter if you operate an online or offline business, if you sell products or services, along the value chain you will most likely have to work with different suppliers.

So, the objective of this step is to make sure you are clear about which partners and suppliers you need, in order to source, produce or build a product, to provide a service and to deliver it to your client.

The easiest way to do this is by mentally going through your value chain. You’ll probably think, ok this is pretty straight forward for a business selling physical products, but how does this apply to tech or service businesses?

But, even if you are a SaaS business you need to develop your tech product, make sure it keeps running, provide customer service and payment options. Or if you are providing physical services, let’s say you are running a beauty salon, you are probably going to need facilities, products for your treatments etc.

It doesn’t matter what you are doing, at one point or another you will have to collaborate with third parties. So, let’s have a look at the typical value chain.

- Sourcing of Resources & Raw Materials – Which resources or raw materials do you need to provide your product or service and where do you get them, are there any Partners involved?

- Production & Operations – What do you need to produce/build your product or operate your services and in general your business, do you need the help of any partners at this step?

- Marketing – How do you communicate your business to your target audience? Do you work with third parties to get the word out?

- Delivery – How do you deliver your product/service to your customers, through which sales channel? Maybe through partner channels? How do you process payments, and how do you get products to the customer or store? Do you need any logistic providers?

- Customer Service – How are you going to provide customer service to your clients? Are you going to do this yourself or work with a partner?

☝️ Go to your Market Environment Analysis 📒Template. We painted a value chain for you. Think about the type of providers and partners you probably need at each step and note them down on the post-its.

Step F

Socio-Economic and Political Environment

Last but not least you want to take a look into the socio-economic and political situation, not only in the country markets you plan to operate in but also world-wide. Meaning what is happening right now in the world and what impact could this have on your venture. Are there any pandemics, economic crisis, wars, political or other changes happening and how are they affecting businesses in different industries?

Also, bear in mind that effects do not always have to be negative for all industries. Take for example the Covid-19 pandemic, the travel restrictions during this time had an enormous negative impact on the hotel and airline industry. However, since people stayed at home usually wearing comfortable clothes, certain players in the textile industry like home and athleisure brands actually benefited from this situation.

💡 There are a number of official organization like the IMF, Worldbank, ECB that provide their analysis on the economic outlook, you will find a selection of those in your Statistics & Data Resources List.

So, go to the corresponding area of your Market Environment Analysis 📒Template and note down your findings on:

- What important developments are happening?

- How could they impact your business?

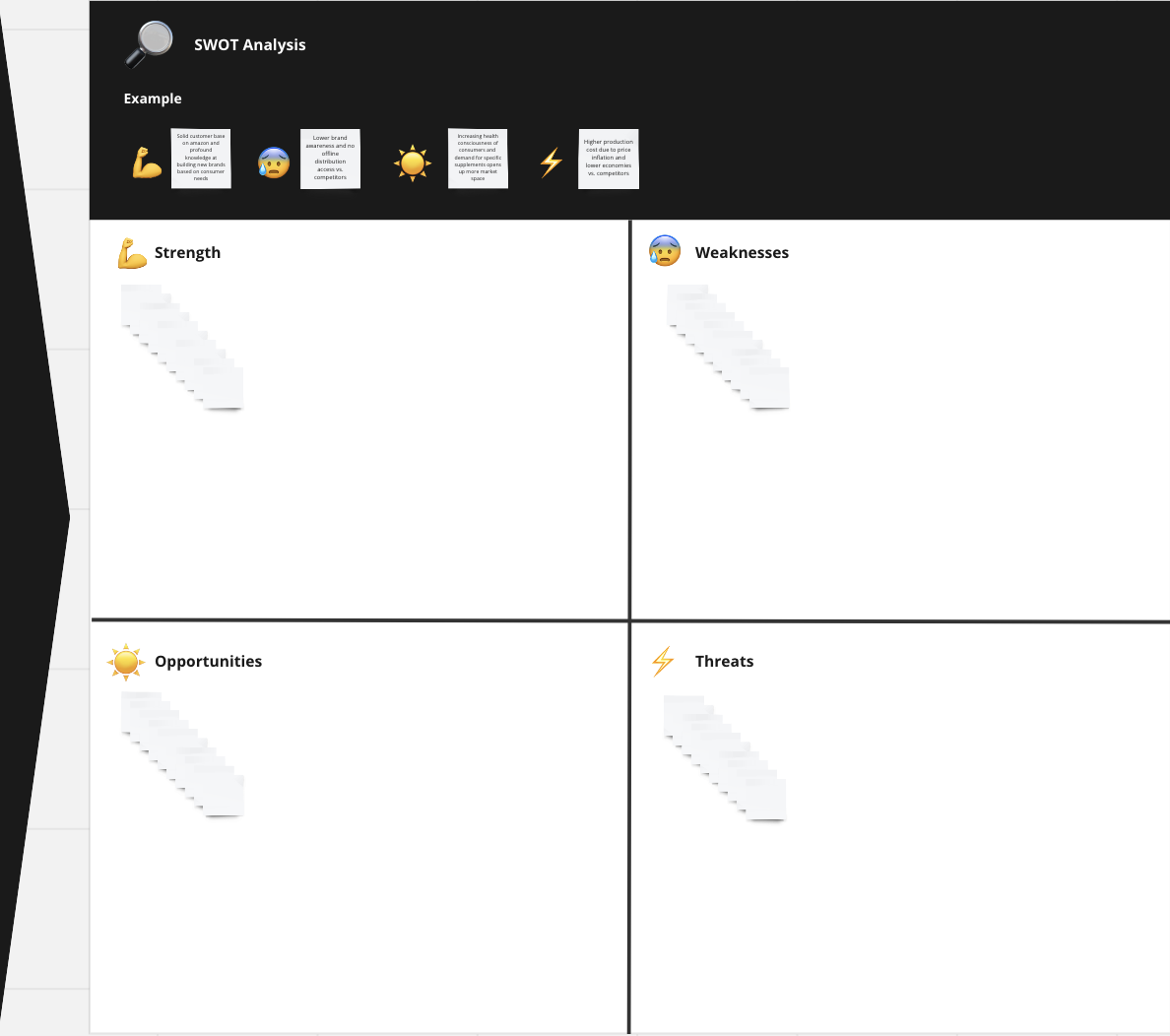

Step G

SWOT Analysis

You are almost finished with your market environment analysis, the only thing left is to summarize your findings in a SWOT analysis, meaning your internal strength and weaknesses and the external opportunities and threats.

Go ahead, look again at all the notes on the whiteboard from your market environment and trend analysis and keeping your findings in mind think about what would be your:

- Strength: What are the things you/your business are especially well at, or even better than your competitors?

- Weaknesses: Where are you less good at compared to your competitors, where do you have a disadvantage compared to them?

- Opportunities: Looking at all those external factors you analyzed, where could an opportunity arise for your business? Which new possibilities do you see?

- Threats: What of those external factors could oppose a threat to your business

☝️ Use the area of your Market Environment Analysis 📒Template we prepared for the SWOT analysis to not them down.