Pricing Strategy Guide

What is a Pricing Strategy?

Another essential part of your Go-To-Market strategy is your pricing strategy. A pricing strategy refers to the overall plan or framework that you use to set prices. Your pricing strategy focuses on how a you determine the appropriate price range and pricing models for your products or services. The pricing strategy takes into account various factors, such as the cost of production, competition, customer demand, and market trends.

The definition of an effective pricing strategy can have a significant impact on your company’s profitability, market share, and customer perception. A well-designed pricing strategy can help you increase your revenue and profitability, while a poorly executed one can lead to lost sales and decreased profitability. The right pricing strategy can help you to:

- Maximizing profit: A good pricing strategy ensures that you are charging the right price for your products or services, which can help maximize profits.

- Create a competitive advantage: A well-designed pricing strategy can help you gain a competitive advantage over your rivals by offering better value to customers.

- Increase customer retention: A pricing strategy that takes into account customer needs and expectations can help you build loyalty and retain customers.

- Capture market share: An effective pricing strategy can help you gain or maintain your market share by positioning your products/services as the preferred choice for customers.

Pricing is a science in itself, and there are lots of different approaches to arrive at the best pricing strategy possible. For this purpose we will try to keep it as simple as possible, so even non-pricing experts can understand and follow the process to define a pricing strategy. We will look into different concepts that make up your pricing strategy one by one, while sticking to the most common models and approaches.

Note: 🍋 Throughout this guide we will use the example of a food supplement company to better illustrate each task and information.

What is a Pricing Strategy Good For?

The definition of an effective pricing strategy can have a significant impact on your company’s profitability, market share, and customer perception. A well-designed pricing strategy can help you increase your revenue and profitability, while a poorly executed one can lead to lost sales and decreased profitability. The right pricing strategy can help you to:

- Maximizing profit: A good pricing strategy ensures that you are charging the right price for your products or services, which can help maximize profits.

- Create a competitive advantage: A well-designed pricing strategy can help you gain a competitive advantage over your rivals by offering better value to customers.

- Increase customer retention: A pricing strategy that takes into account customer needs and expectations can help you build loyalty and retain customers.

- Capture market share: An effective pricing strategy can help you gain or maintain your market share by positioning your products/services as the preferred choice for customers.

How to Define Your Pricing Strategy Step-by-Step:

Step A: Pricing Strategy Template

Step B: Define your Pricing Model(s)

Step C: Choose a Pricing Philosophy and Technique

Step D: Determine your Price Points

Step E: Test and Adjust

Step A

Pricing Strategy Templates

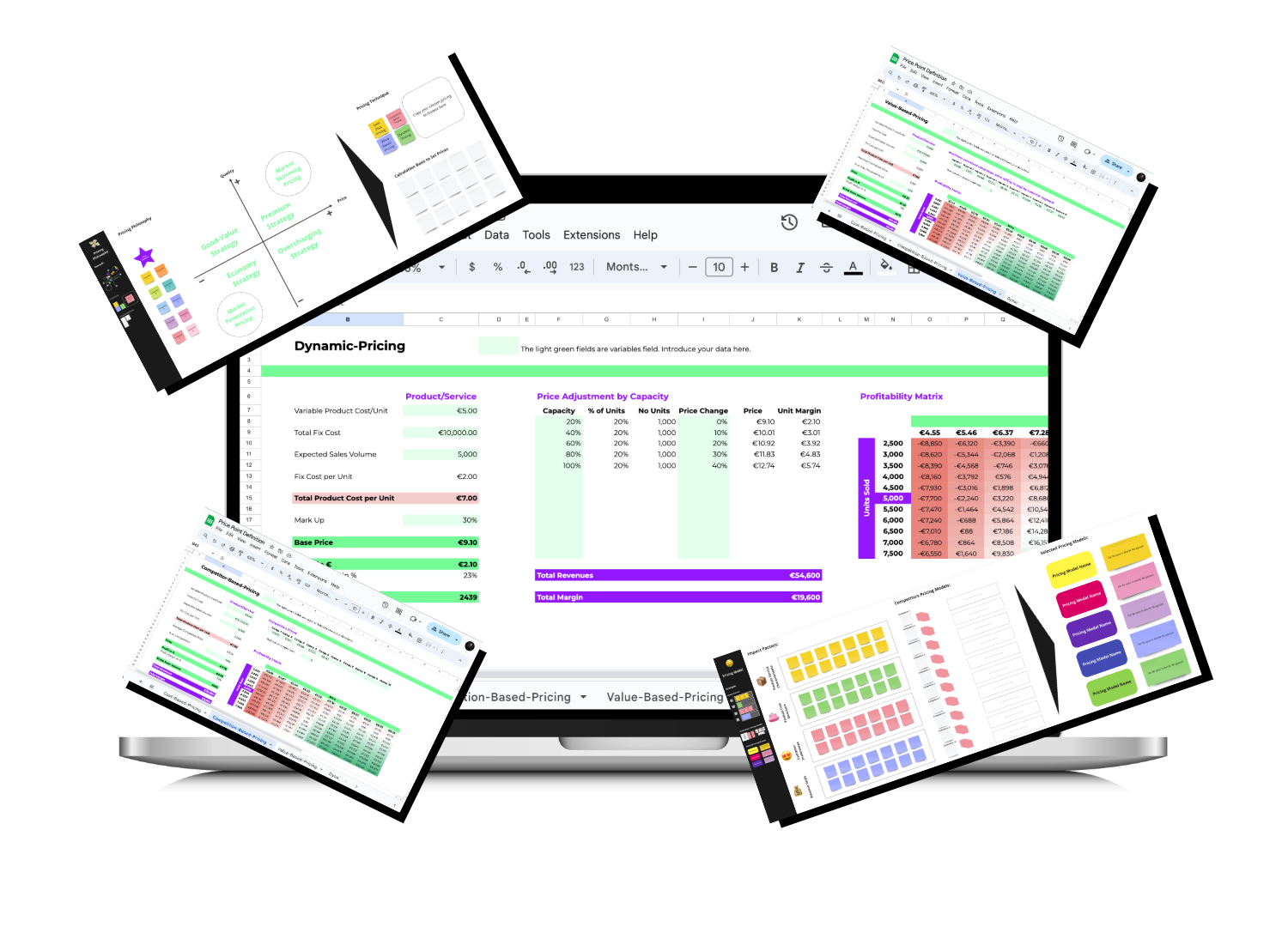

To define your pricing strategy you can either build your own whiteboard template for example on Miro and use Google Sheets to establish your price point or you can use our ready-to-use templates along with this guide.

Included Templates:

Pricing Strategy Miro Board

Price Point Spreadsheet Model

Step B

Define your Pricing Model(s)

A pricing model refers to the specific method or approach that you use to calculate the price of your product or service and how you charge your clients for your products or services.

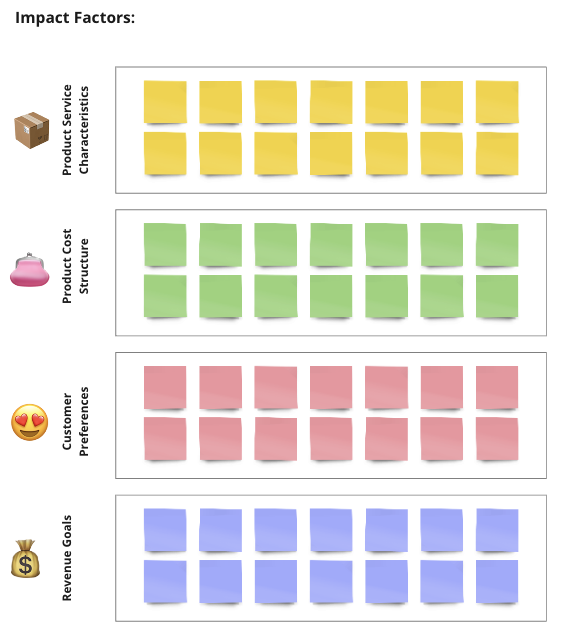

A business can choose to offer one or even different pricing models. Which pricing model is the right one for your business depends on a number of different factors:

- Product or Service Characteristics: The nature of the product or service can influence the pricing model used. For instance, a company offering a range of complementary products may opt for a bundle price to encourage customers to purchase the entire set of products.

- Customer Preferences: The pricing model chosen should be aligned with the preferences of the target customers. For instance, customers may prefer a per-unit price for products that are frequently purchased, such as groceries.

- Competitive Landscape: The pricing model may also be influenced by the competitive landscape. For instance, if competitors are offering subscription models, a company may choose to offer a similar pricing model to remain competitive.

- Revenue Goals: The choice of pricing model can also be influenced by the revenue goals of the company. For instance, a company seeking to maximize revenue may choose a per-unit price model, while a company seeking to increase customer loyalty may opt for a subscription model.

- Cost Structure: The cost structure of the company can also influence the choice of pricing model. For instance, if the cost of producing a bundle of products is lower than the cost of producing each product separately, a company may opt for a bundle price to increase profitability.

With those factors in mind, there are a number of different pricing models to choose from:

| Pricing Model | Short Definition | Example Use Case | Revenue Objectives | Customer Preferences |

| Per Unit Price | Charging customers a fixed price for each unit of a product or service | A bakery charging customers per cupcake | Increase revenue per unit sold | Customers who prefer a simple, straightforward pricing structure |

| Bundled Pricing | Offering a package of products or services for a discounted price | A streaming service offering a bundle of movie and TV show subscriptions for a lower price than buying individually | Increase sales and encourage customers to purchase more | Customers who value convenience and cost savings |

| Tiered Pricing | Offering different levels of service at different prices | A software company offering basic, standard, and premium versions of their product | Cater to different customer segments and increase revenue | Customers with different needs and budgets |

| Freemium | Offering a basic version of a product or service for free, while charging for additional features or upgrades | A productivity app that offers a free version with limited features and a paid version with more features | Attract new customers and encourage them to upgrade to paid version | Customers who are price-sensitive and value flexibility |

| Pay-What-You-Want | Allowing customers to pay what they choose for a product or service | A museum offering a “pay what you want” admission policy | Encourage customer loyalty and build brand reputation | Customers who value transparency and want to support a particular cause or organization |

| Time-Based Pricing | Charging customers based on the length of time they use a product or service | A car rental company charging customers by the hour or day | Increase revenue by charging customers for actual usage | Customers who value flexibility and only need a product or service for a short period of time |

| Flat Subscription Model | Charging customers a fixed price for access to a product or service for a set period of time | A music streaming service charging customers a monthly fee for unlimited access to their library | Predictable revenue stream and customer loyalty | Customers who value convenience and predictability |

| Tiered Subscription Model | Offering different levels of access to a product or service at different subscription prices | A news website offering basic, premium, and VIP subscriptions with different levels of access to content | Cater to different customer segments and increase revenue | Customers with different needs and budgets |

| Perpetual License | Charging a one-time fee for a product with ongoing use | A software company selling a license to use their product with no expiration date | Generate revenue without ongoing maintenance or support costs | Customers who value ownership and want a product with no recurring fees |

| Usage-Based Pricing | Charging customers based on how much they use a product or service | A utility company charging customers based on their usage of electricity or water | Increase revenue by charging customers for actual usage | Customers who value efficiency and want to pay only for what they use |

| VIP Discount Models | Offering discounts or special promotions to loyal or high-spending customers | A retailer offering a VIP program with exclusive discounts and early access to sales | Encourage customer loyalty and increase sales | Customers who value exclusivity and want to be rewarded for their loyalty |

| Always-On Discounts | Offering discounts or sales on a continuous basis | A discount store offering low prices on all products year-round | Attract price-sensitive customers and increase sales volume | Customers who are price-sensitive and want to save money on purchases |

✅ To select the right pricing model(s), start with brainstorming with your team or alone if you are working solo, on the different impact factors. How could each of those impact the decision about your pricing model(s)? Use the first area in your Pricing Strategy 📒 Template to note down your thoughts on the different types of impact factors.

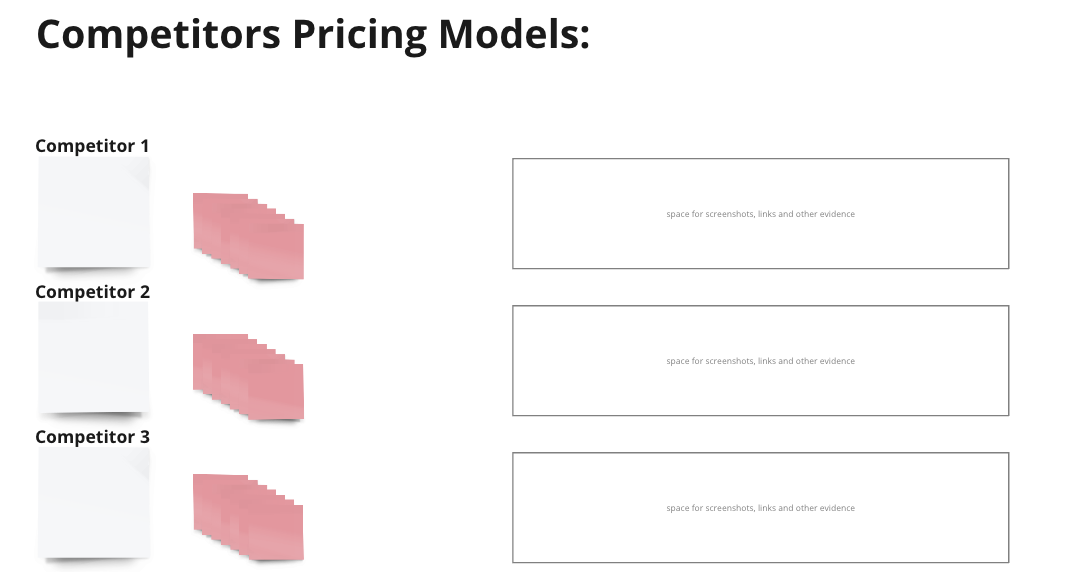

✅ Next, analyze your competitors and try to figure out which pricing model they are using. Use the next area in your Pricing Strategy 📒 Template to note down your competitors’ pricing models on the post-its. You can also add screenshots, links, or any evidence of your competitors’ pricing model(s).

✅ Finally, select your own pricing model(s). Use the corresponding area of your Pricing Strategy 📒 Template to list the pricing model(s) you choose and explain quickly how you are planning to implement them.

Step C

Choose a Pricing Philosophy and Technique

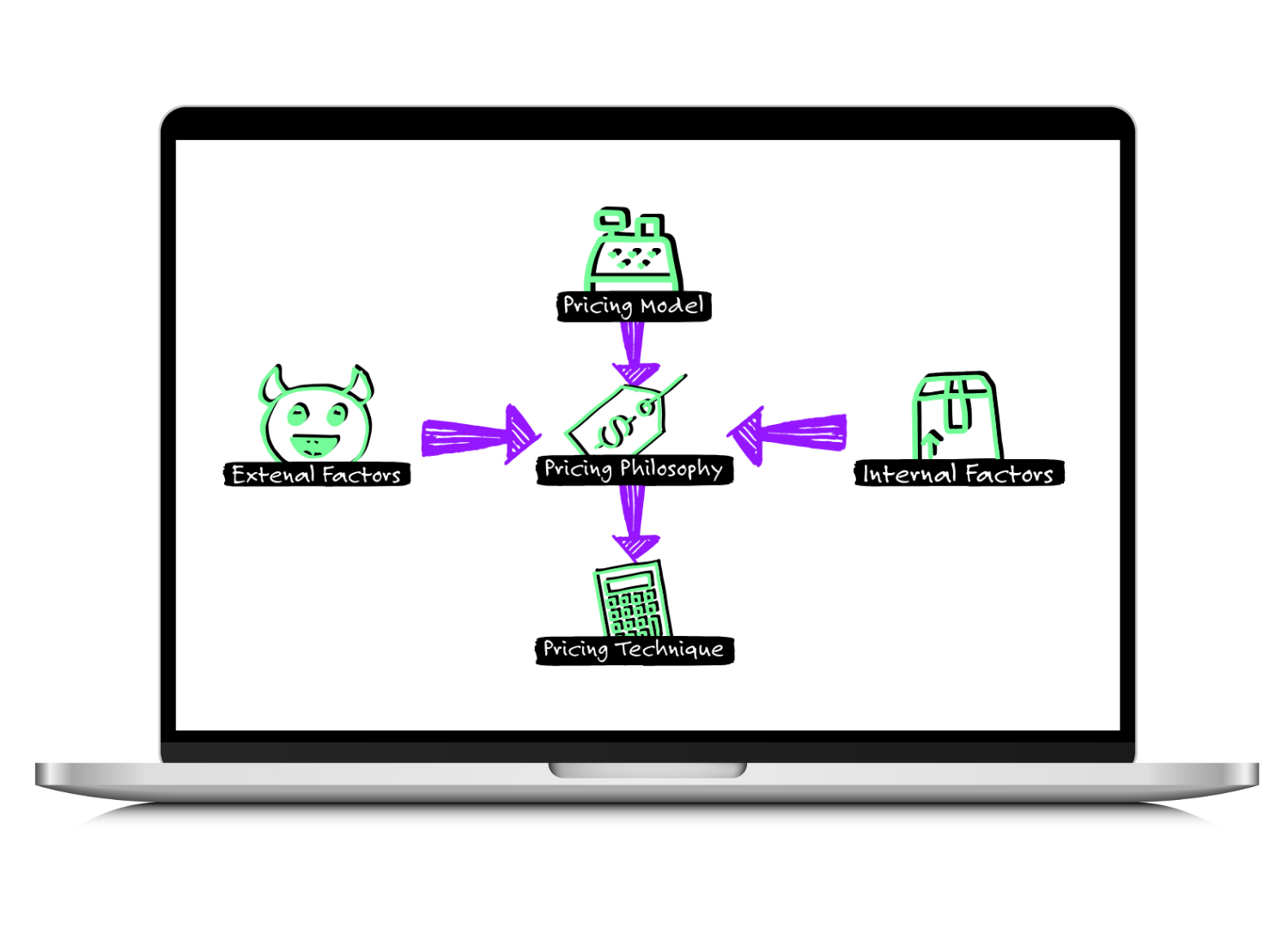

In comparison to the pricing model(s) that determines in which way you charge customers for your product or services, the pricing philosophy and technique determine how much you charge your clients.

Your pricing philosophy is the overarching belief or approach to pricing that a company adopts. The pricing philosophy is sometimes also called the price positioning strategy. It includes the company’s position in the market, its brand identity, and its overall pricing strategy. On the other hand, the pricing technique is the specific method or tactic used to set prices within a pricing model or philosophy.

Your pricing usually changes throughout based on the lifecycle stage of a product or service. At the beginning, you could, for example, charge a lower price to generate first demand and later increase prices with rising brand awareness. However, for now, you want to define the pricing strategy that you will use to launch your product or service to the market.

There are a number of factors that you should consider when selecting your pricing philosophy and technique:

Internal Factors:

- Cost of Production: The cost of production is the most crucial internal factor that affects pricing. The price should be set at a level that covers the cost of production and provides a reasonable profit margin.

- Marketing Objectives: The marketing objectives of the company can also influence pricing decisions. For instance, if the company’s objective is to gain market share, it may set a lower price to attract more customers.

- Brand Image: A company’s brand image can also play a role in the pricing decision. Companies with a strong brand reputation may be able to set a higher price, while companies with a weak brand image may have to set a lower price to attract customers.

- Product Life Cycle: The stage of the product life cycle can also impact pricing decisions. During the introductory stage, companies may set a lower price to attract early adopters, while during the growth stage, prices may be increased to take advantage of increased demand.

External Factors:

- Competition: Competitors’ prices can have a significant impact on pricing decisions. Companies must consider the prices of their competitors and ensure that their prices are competitive and attractive to potential customers.

- Customer Demand: Customer demand is another significant external factor that can influence pricing. If demand is high, companies may be able to charge higher prices, while low demand may require lower prices to stimulate sales. → Price sensitivity

- Economic Conditions: The state of the economy can also affect pricing decisions. During a recession or economic downturn, companies may have to lower prices to remain competitive and maintain sales.

- Regulatory Environment: Regulatory environment, including taxes, tariffs, and other government regulations, can also impact pricing decisions. Companies must consider the impact of these factors on their pricing strategy.

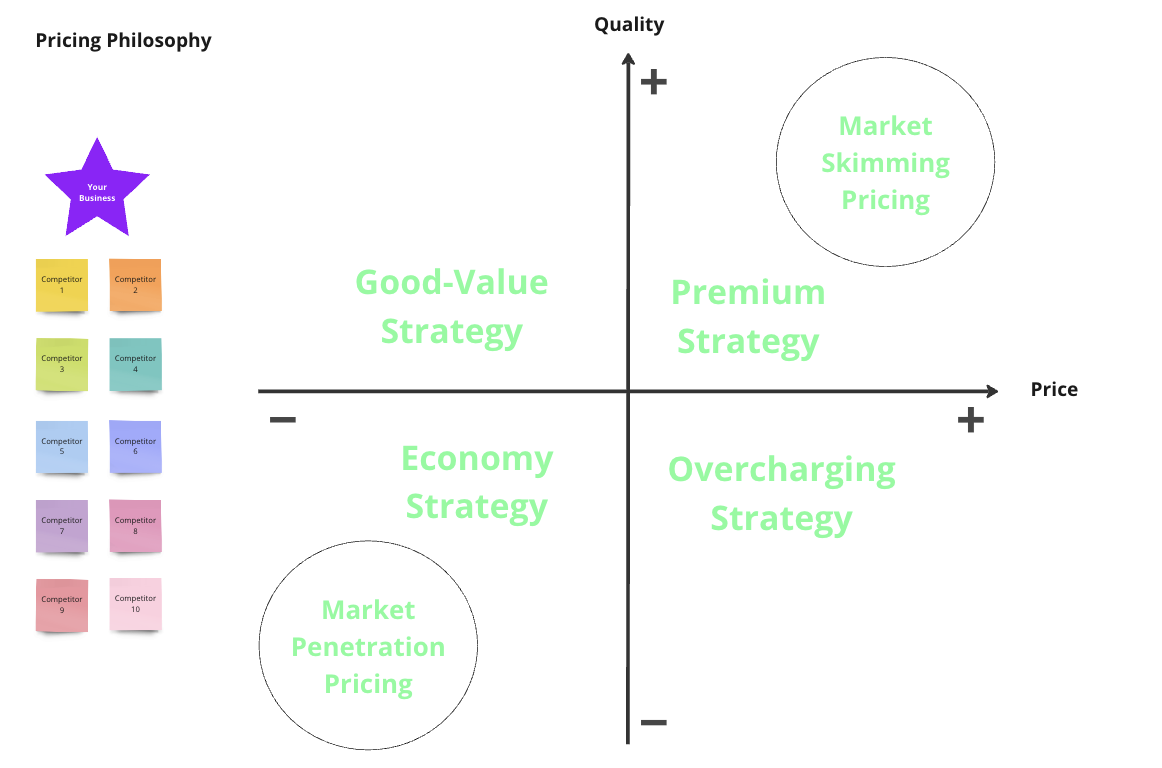

Pricing Philosophy

As mentioned earlier, the pricing philosophy you choose also determines your positioning relative to your competitors, which is why it has to be carefully selected with your competitors in mind. There are four overarching pricing philosophies: the premium strategy, the good-value-strategy, the economy strategy, and the overcharging strategy. Plus there are two “extreme” pricing strategies that are usually only applied when introducing a new product or service into the market.

|

Philosophy |

Definition |

Typical Use Cases |

Impact on Revenue Objectives |

|

Premium Strategy |

Offering high-quality products at a premium price point to create a perception of exclusivity and luxury. |

Luxury fashion, high-end technology products |

Maximizes revenue through higher profit margins, but may limit market reach and appeal to price-sensitive customers. |

|

Good-Value Strategy |

Offering products at a reasonable price while maintaining high quality to create value for the customer. |

Discount retailers, private label brands |

Can increase market share and appeal to price-sensitive customers, but may not maximize revenue per unit sold. |

|

Overcharging Strategy |

Setting prices significantly above the perceived value of the product or service. |

Monopolies, price gouging |

May maximize revenue in the short term, but can damage reputation and lead to loss of customers in the long term. |

|

Economy Strategy |

Offering products at a low price point to appeal to price-sensitive customers. |

Dollar stores, fast food chains |

Can increase market share and appeal to price-sensitive customers, but may not maximize revenue per unit sold. |

|

Skimming pricing |

A pricing method that sets high prices for new and innovative products |

A tech company that launches a new smartphone model |

High profit margins, recoup investment costs, market segmentation |

|

Penetration pricing |

A pricing method that sets low prices for new products to attract customers and gain market share |

A new coffee shop that wants to attract customers |

Market share growth, customer acquisition, discourages competition |

✅ So, as a first step, choose the branding philosophy you want to follow. Take into account the above mentioned factors and use the corresponding area of your Pricing Strategy 📒 Template, to analyze your competitors’ pricing philosophie and place them in the right quadrant. Finally choose your position relative to your competitors and place the star icon at its location.

Pricing Technique

Once you have determined your pricing philosophy you also want to decide on your pricing technique, which is basically how you will calculate your price range and what you are going to use as a basis for calculation. Again the right pricing technique for your business depends on the internal and external factors mentioned above.

Here is an overview of the most common pricing techniques:

|

Technique |

Short Description |

Example Use Case |

Revenue Objectives |

|

Cost-plus pricing |

A pricing method that adds a markup to the cost of a product or service to determine the selling price |

A manufacturing company that produces a new line of furniture |

Profit maximization, break-even, and cost recovery |

|

Competition-based pricing |

A pricing method that sets prices based on the prices charged by competitors |

A restaurant that sells pizza in a highly competitive market |

Competitive advantage, market share growth, customer retention |

|

Value-based pricing |

A pricing method that sets prices based on the perceived value of a product or service to the customer |

A luxury car manufacturer |

Revenue maximization, profit maximization, customer satisfaction |

|

Dynamic pricing |

A pricing method that adjusts prices in real-time based on supply and demand, customer behavior, and other factors |

An airline that offers different prices for flights based on demand and booking times |

Revenue maximization, competitive advantage, customer retention |

✅ So, think about which pricing technique would be the right one for you, and add the chosen technique to the corresponding area of your Pricing Strategy 📒 Template. Then note what you would use in detail as a calculator basis. For example if you decide to go with competition based pricing, indicate which competitors you would take into account for your pricing decision.

Step D

Determine your Price Points

In the next step we will focus on calculating the right price point for your product or service. The price point refers to the specific price at which you offer your products or services for sale. It is the amount of money that a customer must pay to purchase a product or service.

Finding the right price to maximize profit is an art in itself. Depending on the price elasticity of your product category, just small adjustments in the price can have a huge impact on the demand for your product/service.

Demand price elasticity refers to the degree of responsiveness of the quantity demanded of a good or service to changes in its price. In other words, it measures how much the quantity demanded or supplied changes in response to a change in price.

Price elasticity is calculated by dividing the percentage change in the quantity demanded or supplied by the percentage change in price. If the resulting value is greater than 1, it indicates that the quantity demanded or supplied is highly responsive to changes in price (i.e., the product or service is price elastic). If the resulting value is less than 1, it indicates that the quantity demanded or supplied is not very responsive to changes in price (i.e., the product or service is price inelastic).

% Change in the Quantity Demanded / % Change in Price = Price Elasticity

Also as mentioned earlier, the price you set during the product launch is not definite. You will surely have to adjust your price point over time, based on changes in the external or internal factors we discussed in the previous chapter.

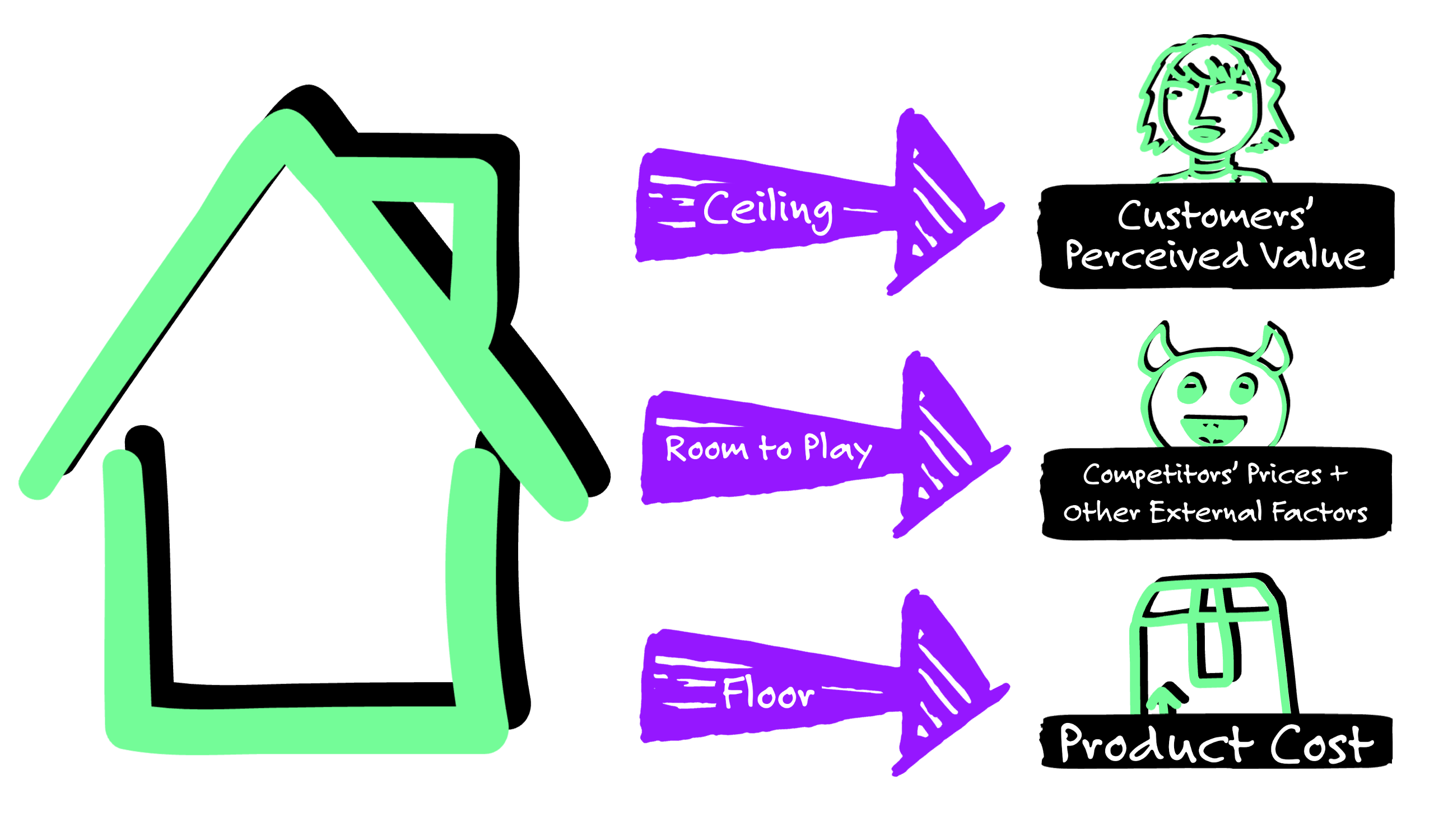

Whatever pricing philosophy you are following and wherever you set your price it will always have to move between your product cost as the floor and the consumers’ perceived product/service value as the ceiling.

If you sell a product/service below your product cost you wouldn’t make any profits. If you sell your products above its perceived value you won’t be able to generate demand, since consumers would not be willing to pay a price higher than their perceived value.

The space in between is your room to play with the price. However, even here you will have to take into account your competitors’ prices and other external factors.

As mentioned, we have prepared a Price Point Definition Spreadsheet 📒 Template that you can use to set your pricing. In the four tabs you will find separate models for each of the four pricing techniques. So choose the tab you need based on the pricing technique you selected.

Below we will explain to you how to use each model.

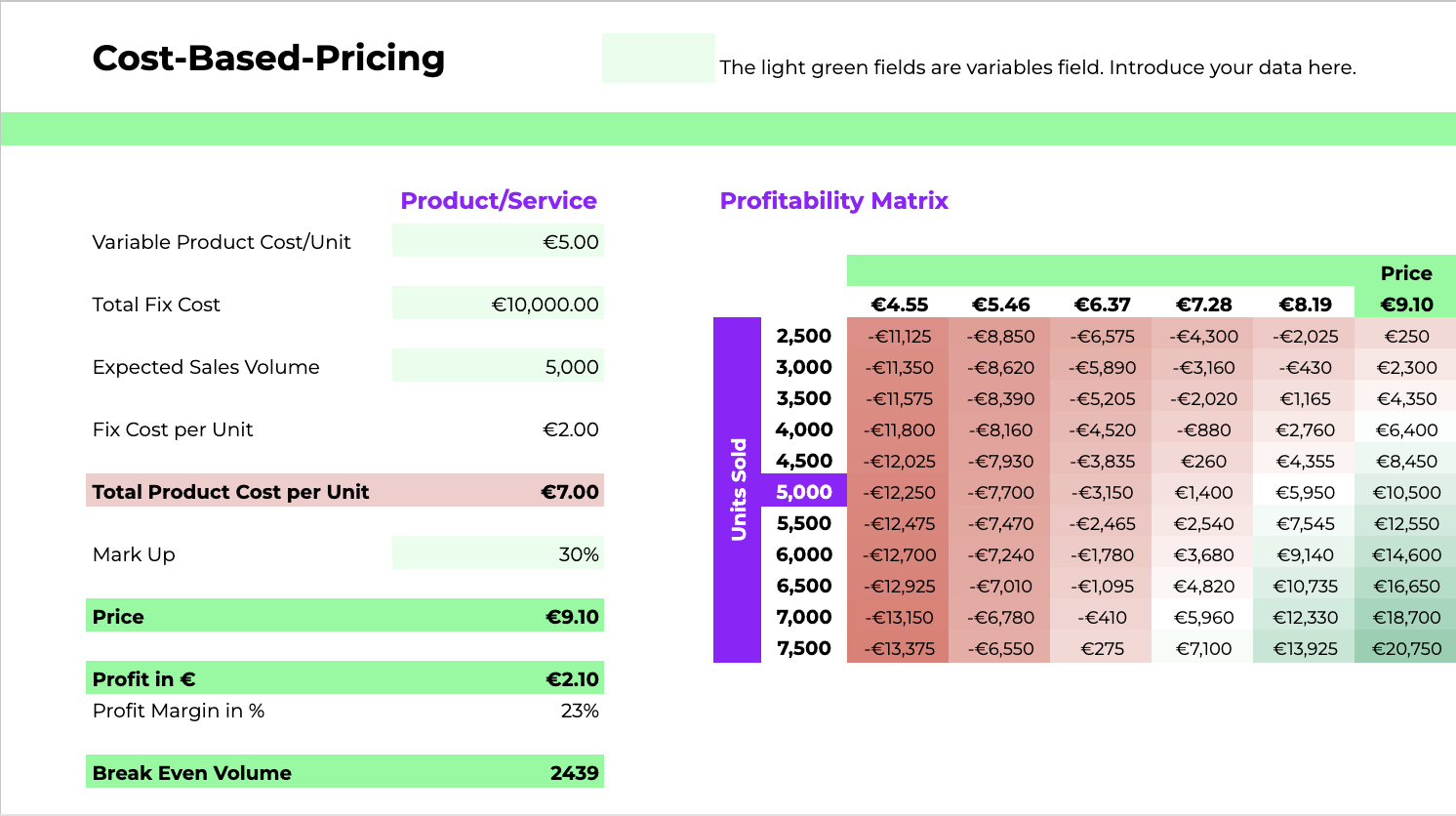

Define your Price Point Using Cost-Based-Pricing

In the first tab of your Price Point Definition Spreadsheet 📒 Template you will find the model to calculate your price point using the cost-based-pricing technique

You can adjust the model by introducing your data in the light green fields.

Cost-based pricing is a pricing technique in which the price of a product or service is determined by adding a markup to the cost of producing or providing it.

✅ Calculate Product Cost Per Unit

Therefore the first thing you want to do is calculate your product cost per unit. The product costs are usually a mix of variable and fixed cost.

Variable costs are expenses that vary with the level of production or sales. As the production or sales volume increases, the variable costs also increase proportionally, and vice versa. They can be attributed directly to one product/service unit. This could be for example raw materials, components or packaging.

🍋e.g. the variable product cost of one box (unit) of a food supplement lets say collagen capsules would be: the ingredients needed to produce the capsules 2 EUR + the packaging box 1 EUR + the labels 0.5 EUR = Variable

Fixed costs, on the other hand, are expenses that do not vary with the level of production or sales. These costs are typically incurred regardless of how much or how little the product is produced or sold. They usually can not be attributed directly to one product/service unit. This could be for example salaries and wages, rent, utilities and so on.

🍋e.g. The annual fixed product cost of a business that sells food supplement, would be: wage of production worker 40K EUR + salary of administration staff 50K EUR + rent of production machinery 50K EUR + utilities 10K EUR = 150K EUR

So to calculate the product cost per unit

- Introduce the total Variable Product Cost/Unit

- Introduce the Total Fixed Cost

- Introduce the Expected Sales Volume (number of units)

The model divides total fixed cost by the total sales volume which will give you the fixed cost per unit. Adding the variable cost per Unit and the fixed cost per unit will give you the Total Product Cost per Unit.

Variable Product Cost/Unit + (Total Fixed Cost/Expected Sales Volume) = Total Product Cost per Unit

✅ Add your Markup

Next, define your markup. A markup is the percentage added to the cost of a product or service to arrive at its selling price. In other words, it is the difference between the cost of producing or providing a product or service and the price at which it is sold.

So, input your desired markup percentage. The spreadsheet model will add this markup to your product cost per unit, giving you the price for one unit.

Price = Product Cost per Unit x (1 + Markup %)

✅ Calculate your Profit and Margin

The profit per unit is calculated by subtracting the product cost per unit from the price:

Price – Product Cost per Unit = Profit

The profit margin represents the percentage of revenue that a business earns as profit after deducting all the costs associated with producing or providing its products or services. It is calculated as follows:

Profit Margin = (Net Profit / Revenue) x 100

On the right side of your spreadsheet, you will find a profitability analysis matrix, which automatically gives you the expected total profit depending on how prices and the expected sales volume change.

✅ Calculate your Break-Even-Volume

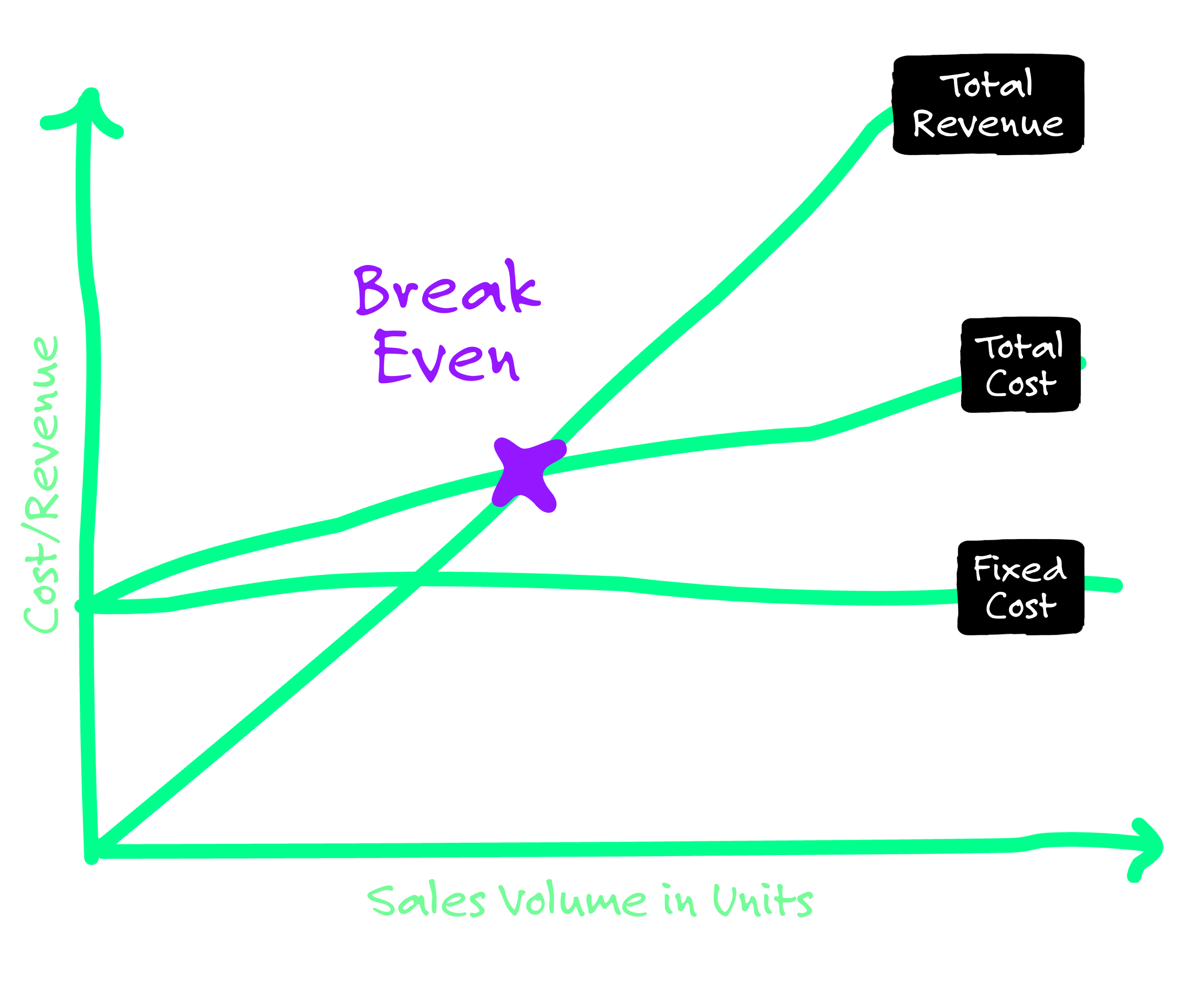

The spreadsheet model also calculates the break even volume. The break-even volume is the level of sales volume at which a business is able to cover all of its costs and generate zero profit. In other words, it is the point at which the total revenue generated by a business is equal to its total costs.

The break-even volume can be calculated using the following formula:

Break-Even-Volume = Fixed Costs / (Price per Unit – Variable Costs per Unit)

The break-even volume is an important metric because it helps you determine the minimum sales volume required to cover your costs and achieve profitability.

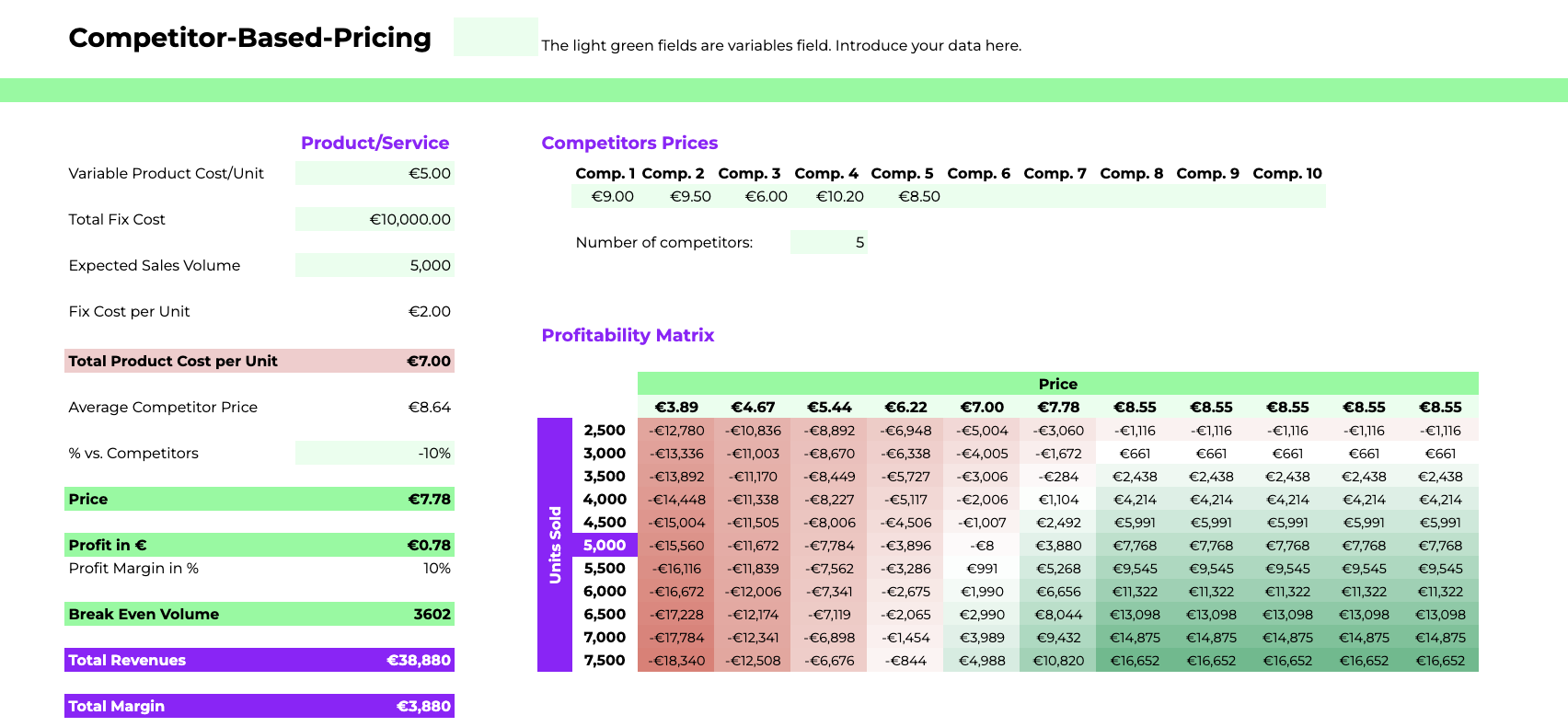

Define your Price Point Using Competition-Based-Pricing

Competition-based pricing is a pricing technique in which you set your prices based on the prices charged by your competitors in the same market or industry. The goal of this strategy is to remain competitive and capture market share by offering similar or lower prices than competitors.

This can be done by setting prices at the same level as competitors or by setting prices slightly lower or higher, depending on the business’s goals and competitive position in the market.

There are two main approaches to competition-based pricing:

- Price leadership: In this approach, you set your prices slightly below the prices charged by the market leader in order to capture market share and gain a competitive advantage.

- Price following: In this approach, you set your prices at the same level as your competitors in order to remain competitive and avoid losing market share.

To calculate your price point using the competition-based techniques, use the second tab in your Price Point Definition Spreadsheet 📒 Template and follow these steps:

✅ Calculate Product Cost Per Unit → Follow the same steps as for Cost-Based Pricing.

✅ Analyze your Competitors’ Price Point

Next, research and analyze your competitors’ prices. There are, of course, price analysis tools out there that you can use if you want to, but for this purpose, a manual analysis should be sufficient. Therefore, go to the competitors’ website or other third-party online marketplace where the competitor sells their products/services (e.g. Amazon) and check their prices. Depending on whether you are looking at a single product/service or a portfolio of products/services, the price point can be reflected in a single price or a price range.

In order for the price analysis to make sense, you want the products/services, of course, to be comparable:

- If the competitors are offering a wide range of products/services in the same category (e.g. different food supplements), pick a number of products that are common or most similar for the different competitors and compare their prices.

- If competitors are offering different product levels, for example, a basic, medium, and professional level, which is very common for SaaS products, pick one, for example, the basic level service, and compare the prices of those.

- If competitors are offering different numbers of product/service units, bring them down to the same unit. For example, one competitor offers an annual SaaS subscription, the other a monthly subscription. Use always the price for one month. Or one competitor offers their products in single units, the other only in bundles of 10 units. Use always the price for one unit.

✅ Calculate your Competitors’ Average Price

Now, introduce the competitor prices that you want to use as a reference in your spreadsheet, the spreadsheet model will automatically calculate the simple average to use as reference price.

((Price Competitor 1) + (Price Competitor 2) + (Price Competitor …)) / Number of Competitors = Average Reference Price

✅ Calculate your Price Point

Next, define the price delta as the percentage increase or decrease versus the competitor reference price. Enter it into your spreadsheet model (percentage versus competitors). This will automatically calculate your price point.

Average Reference Price x (1 + % versus competitors) = Price Point

✅ Calculate your Profit and Margin → Follow the same steps as for Cost-Based Pricing

✅ Calculate your Break-Even-Volume → Follow the same steps as for Cost-Based Pricing

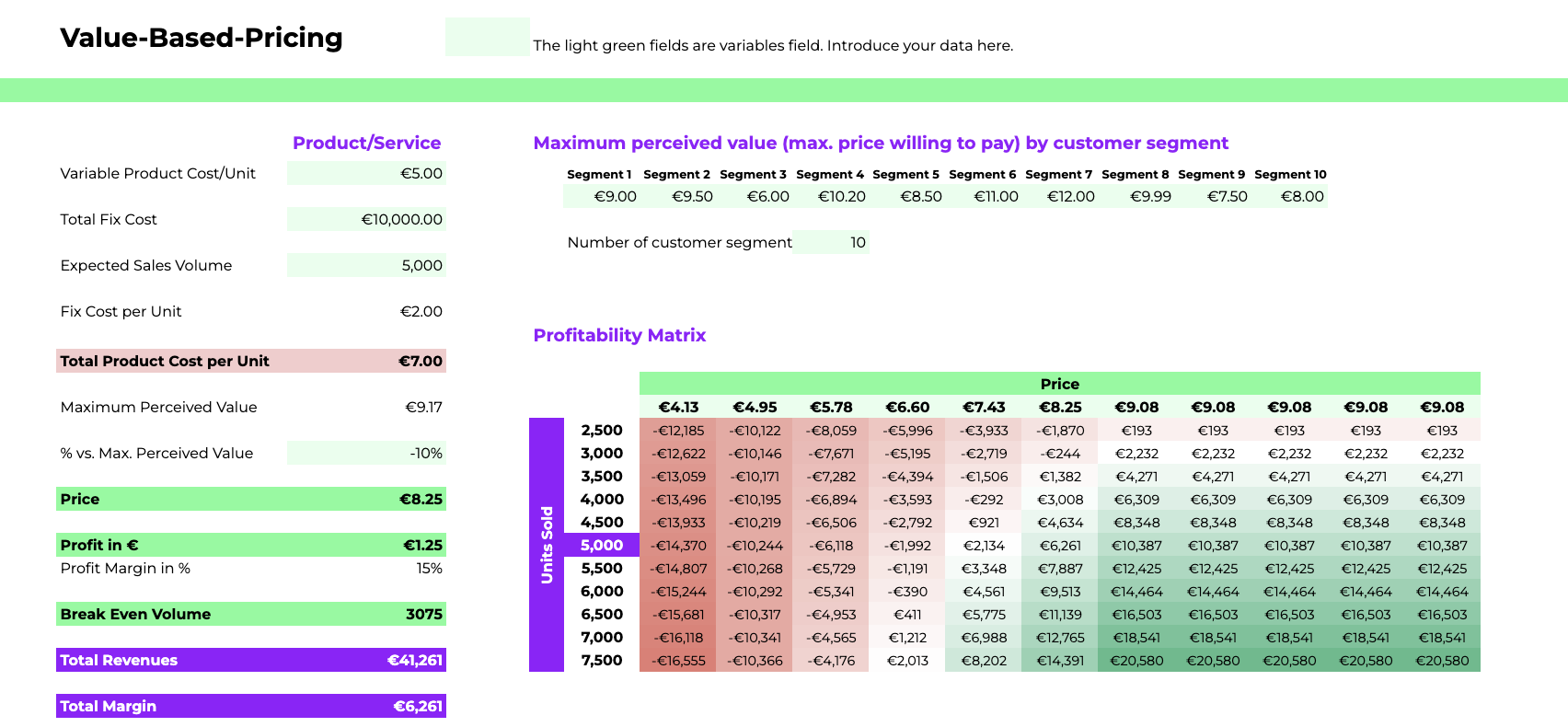

Define your Price Point Using Value-Based-Pricing

Value-based pricing is a pricing technique that sets the price of a product or service based on the customers’ perceived value of the product/service. Instead of simply setting a price based on production costs or competition, value-based pricing takes into account the customer’s willingness to pay for the benefits they receive from the product or service.

To implement value-based pricing, you must first determine how much customers are willing to pay for that value. Once you have determined the value of the product or service, you can set a price that reflects that value, rather than simply trying to undercut the competition or meet a certain profit margin.

✅ Calculate Product Cost Per Unit → Follow the same steps as for Cost-Based-Pricing

✅ Research and Analyze the Perceived Product Value

As mentioned earlier, to use value-based pricing, you will first have to determine how much customers would be willing to pay for the type of product or service you are offering. Moreover, this willingness to pay probably differs between the various customer segments that you are targeting. So if you are targeting several segments, you will have to study each segment.

There are different ways to analyze the perceived value of your customer segments:

- Conduct Market Research: Surveys, focus groups, and interviews can be used to gather feedback from potential customers and identify their willingness to pay.

- Experimentation: You can experiment with different pricing strategies to determine the optimal price point. For example, you can use A/B testing to test different prices and measure the impact on sales.

- Price Sensitivity Analysis: Conducting a price sensitivity analysis can help determine how price affects demand for the product or service. This can involve changing the price of the product or service and measuring the impact on demand. This can provide insight into what price points customers are willing to pay for the product or service.

- Competitor Analysis: You can also analyze the pricing strategies of their competitors to understand the market and customer preferences. This can provide insight into what customers are willing to pay for similar products or services.

As you can see, this is probably the most elaborate pricing technique since it involves conducting the pre-work to figure out the right price point.

✅ Calculate the Average Perceived Product Value

Once you have determined the perceived value of the different customer segments, so the maximum price they are willing to pay, you can calculate the average perceived value of all segments. Simply introduce the maximum perceived values for each segment you want to take into account in your spreadsheet and indicate the number of segments. The model will automatically calculate the average.

((Value Segment 1) + (Value Segment 2) + (Value Segment …)) / Number of Segments= Maximum Perceived Value

✅ Calculate your Price Point

Then define the price delta, meaning the % increase or decrease versus the customers’ perceived value. Introduce it in your spreadsheet model (% vs. Max. Perceived Value), this will automatically calculate your price point.

Maximum Perceived Value x (1+% vs. Max. Perceived Value) = Price Point

✅ Calculate your Profit and Margin → Follow the same steps as for Cost-Based Pricing

✅ Calculate your Break-Even-Volume → Follow the same steps as for Cost-Based Pricing

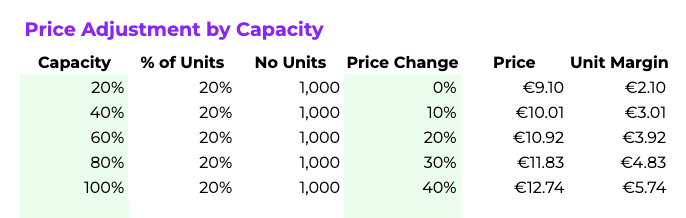

Define your Price Point Using Dynamic Pricing

This pricing technique is probably the most elaborated one. Dynamic pricing is a pricing technique in which the price of a product or service is adjusted in real-time based on various factors such as supply and demand, customer behavior, and market conditions. This means that the price of the product or service can change frequently and rapidly. By adjusting prices based on real-time demand, companies can increase profits and reduce waste by selling inventory at the highest possible price.

Dynamic pricing is commonly used in industries such as airlines, hotels, and e-commerce, where prices can fluctuate based on factors such as the time of day, day of the week, season, and even the weather.

In the spreadsheet model we provide a very basic example to calculate different dynamic price points based on capacity utilization (or demand). So this will serve as a financial model to understand your basic profitability at different dynamic price points. But to fully introduce this pricing technique you will probably have to use a dynamic pricing software that automatically adjusts the prices in your sales channels. Dynamic pricing softwares uses sophisticated algorithms and data analytics to analyze market trends and customer behavior, in order to optimize prices for maximum revenue.

✅ Set your base price point

The first thing you want to do is to determine your base price, in the model we used cost-based-pricing to arrive at the base price, so you can just follow the steps for cost-based-pricing to calculate your base price.

✅ Determine your price adjustments by capacity

In the next step we will now define how the base price changes (increases or even decreases based on the capacity utilization.

First define your capacity utilization ranges, meaning at which capacity you want to change the price. In our example the price changes once capacity has reached 20%, then again when it has reached 40%, then at 60% utilization and so on.

Once you define the capacity ranges you can then define the price change in % for each range. In our example for a capacity utilization of up to 20% there is no change, we sell at the base price, once reached the 20% capacity and up to 40% we increase the price by 10% and so on.

Once you introduce the price ranges the model will automatically calculate the corresponding price points and unit margins.

✅ Calculate your Profit and Margin → Follow the same steps as for Cost-Based Pricing

✅ Calculate your Break-Even-Volume → Follow the same steps as for Cost-Based Pricing

Step E

Test and Adjust

We have already explained this several times in this work package, but just to remind you again: the price you have just set won’t stay the same. It is common to keep adjusting your price as external or internal factors change, or you gain new insights.

You actually want to start testing and probably adjusting the price points you have defined right away.

There are a number of methods that you can use to test your pricing:

- A/B Testing: A/B testing is a method of testing two different versions of a product or service to determine which one performs better. Companies can test different price points on different groups of customers to see which price point generates more sales or revenue.

- Conjoint Analysis: Conjoint analysis is a market research method that involves asking customers to rank different product or service features and price points. This helps companies understand the relative importance of different features and price points to customers and can help identify the optimal price point.

- Surveys: Surveys can be used to gather feedback from potential customers on the price point of a new product or service. This can provide insight into customer preferences and expectations and can help determine if the price point is too high or too low.

- Price Sensitivity Analysis: Price sensitivity analysis involves changing the price of a product or service and measuring the impact on demand. By testing different price points, companies can determine the optimal price point that maximizes revenue.

- Competitive Analysis: Competitive analysis involves researching the pricing strategies of competitors to determine how the new product or service compares in terms of price and value. This can help identify if the price point is too high or too low compared to similar products or services.

So keep on testing and adjusting your prices, to maximize your profits and customer retention.

Well done! With this you finish your pricing strategy work package. See you tomorrow for the next one.